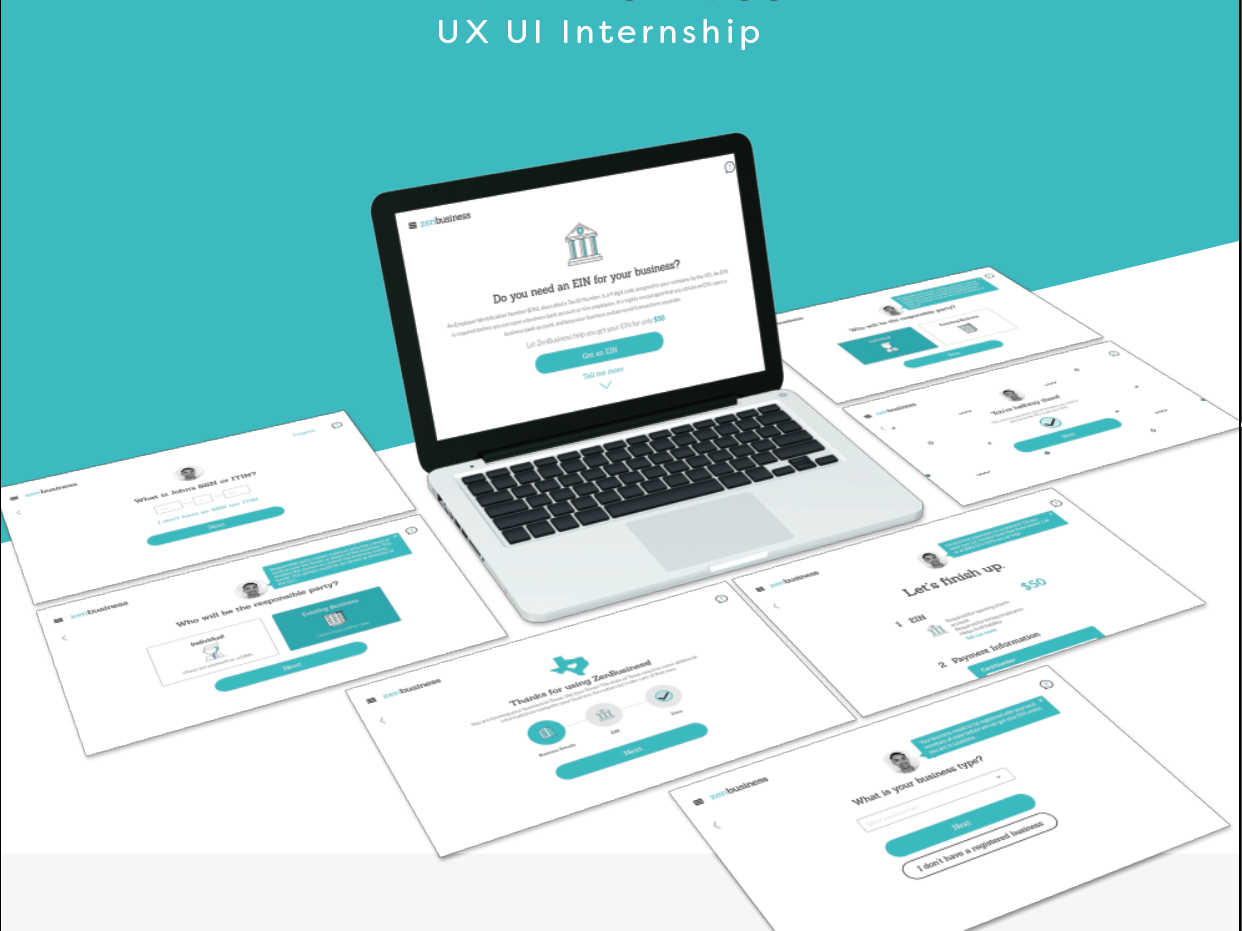

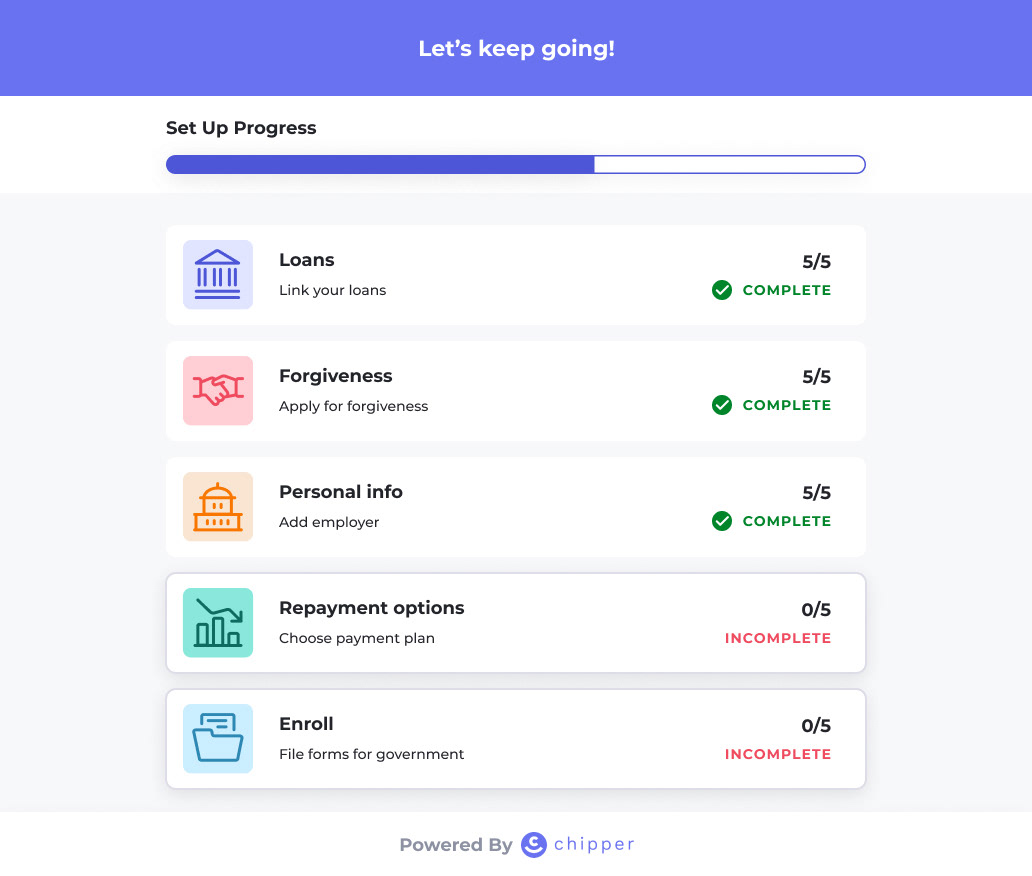

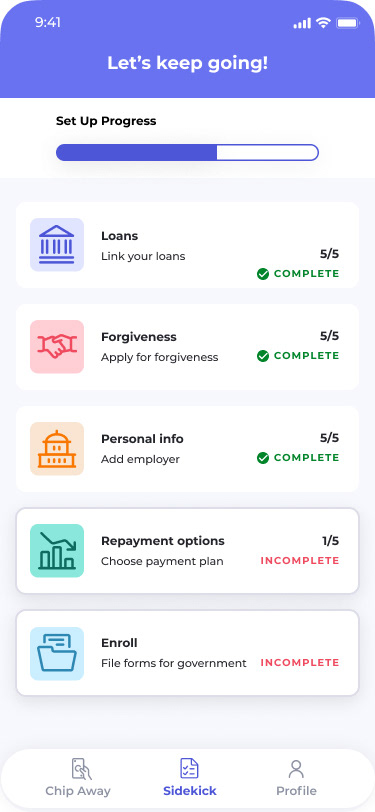

Currently working to Automate the entire enrollment process (Dec 2020 Release)

The Forgiveness Programs

Did you know 99%+ of student loan borrowers who’ve applied for Public Service Loan Forgiveness have been denied!?! This includes teachers, nurses, police officers, non-profit employees, and any one else working in public service. It’s an awful situation. I’m proud to say that our team at Chipper has been working hard over the last couple of months on a forgiveness tool that helps people determine if they’re eligible and handles all the messy paperwork to make sure no teacher or nurse ever gets denied again.

Focussing on Forgiveness Qualifiers, we are re-building the app with information needed to get them applied and accepted by the U.S. department of Education. This is a very long, difficult process for all applicants. With the intention to automate the documents, get them signed and sent to the right people, and offering consultation and a chat feature, we can help users choose the right repayment plan along with applying to the qualifying forgiveness programs at ease.

Forgiveness Programs

Chipper Concierge

We added three plan types to give the user options for how much help they want from us. The three plans are Chipper Concierge which allows 1-on-1 access to our team of student loan experts, and electronically complete documents. The second is a combination which allows digitally prepared applications and access to our document reminders. The last is do it yourself where we offer a guide and packet of .pdf's to fill out and turn in on your own. This allows the business to start earning revenue and also allows for less human error.

Repayment Plan Options

This is one of the hardest parts for student loan borrowers to understand. There are many repayment plan options, but which one should you choose? The lowest payment per month? The shortest term? Well.. this actually depends on who you are and what your goals are. So there is a lot of options, but the most important thing student loan borrowers trying to qualify for forgiveness should know is that they must be on an income-driven repayment plan to qualify. So we explain this and help them go through the process if we know they qualify. We try to offer as much information as we can to guide them, along with great UI for comparing plans. We also offer the chat feature here if they need help deciding.

Repayment plan options

Chipper Concierge options

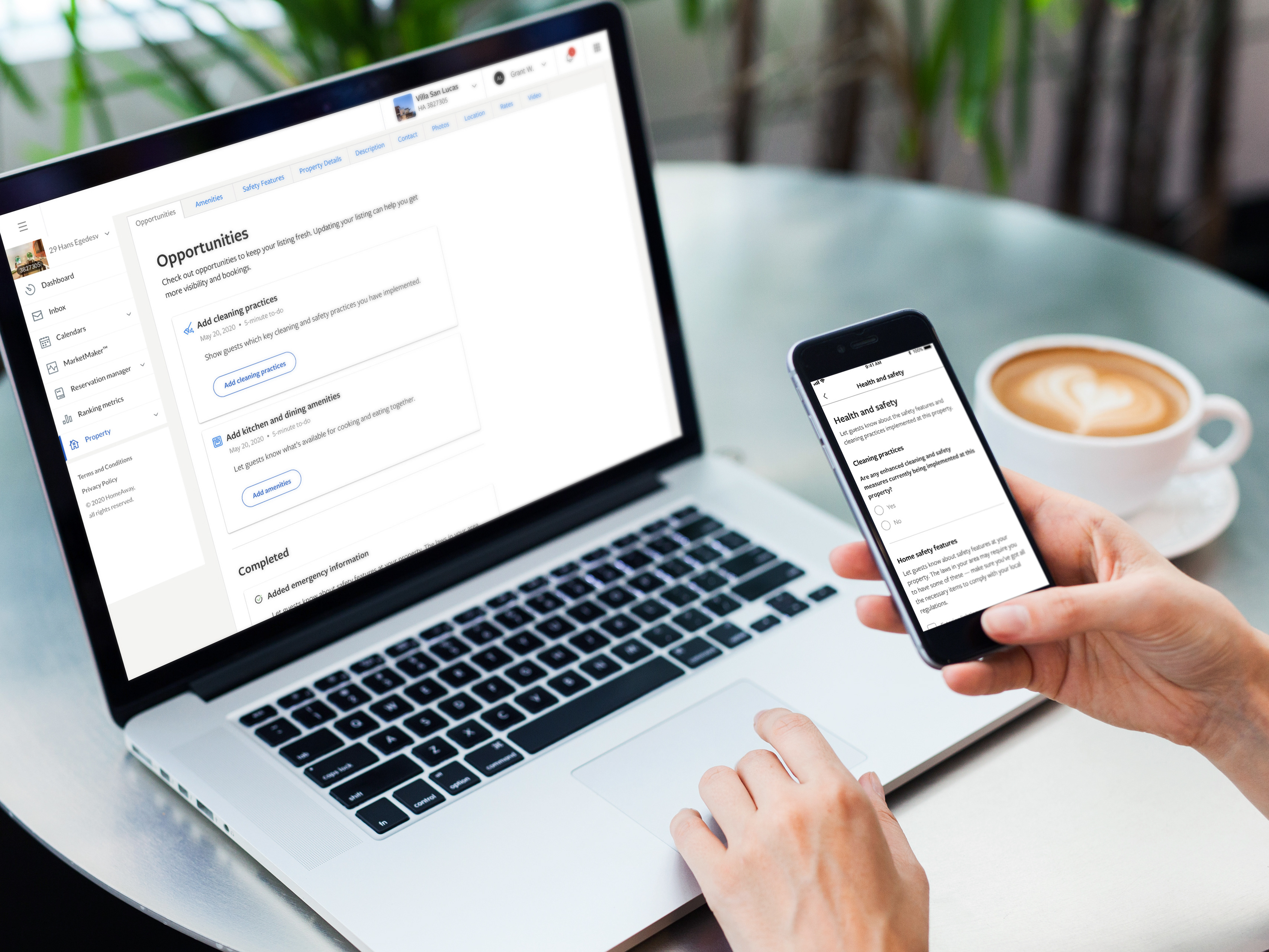

Digital Documents

Digital documents are the way to go these days, but this is a huge game changer for student loan applications. There are several documents you need to complete and fill out every year along with major life changes you have to keep up with. This will allow the user to not have to enter information twice, and we can populate the information we collected during on boarding. This also allows us to sent them directly to the U.S. department of education. We can also allow dual signatures for the Employer Certification document. We also send them email confirmations with a .pdf of the filled out document so they can store it themselves.

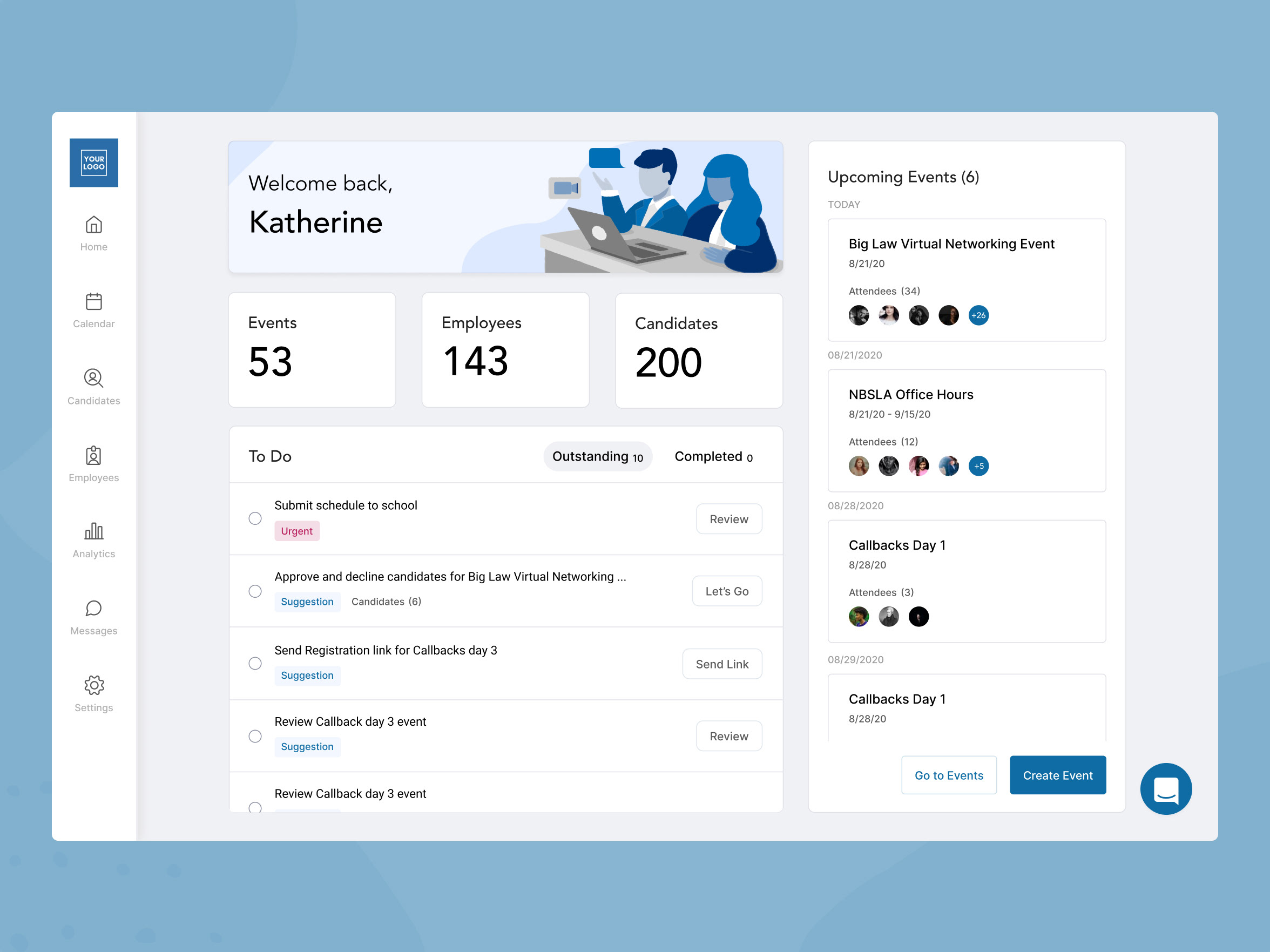

New Dashboard

The new dashboard is a clear way to view your current loans, repayment plan, total loan balance, and any documents you may completed with Chipper. We can also set up automatic reminders, and consultations to help users forgive up to $100,000 in student loan debt.

How I met Chipper

After my apprenticeship at Funsize, I got hired by one of their clients Chipper to be their UI/UX designer. I on boarded super quick and got to work right away. This was a great first jump into my first job. I was the only designer at the company so I basically got so much responsibility, which I loved! I was also in awe of the CEO Tony who was so passionate about fixing the student debt of America. He has already created a company to help this problem, and was now creating this app to lower the student debt. It is insane how many people are just on the wrong plan, or can't manage their payments, or apply for the plan the wrong way and get denied. I couldn't wait to help make a difference.

I quickly started by redoing their entire design library because I noticed inconsistency and knew if I started with this, it would make the rest of my work that much easier. I updated their colors, for product and marketing, and made a typography style guide, and updated icons.

Student Loan Forgiveness

Right away I was tasked with creating a flow for their newest feature that helps people sign up for the Student Loan Forgiveness plan. The stats on how many people get denied after application is crazy! More than 100,000 people who applied were rejected! Why do 99% of people get rejected? It's actually quite simple... there are three major parts to the process in which things can go wrong.

1) You might be on the wrong repayment plan

2) You might have not provided all of the information

3) You may not have eligible loans

How can we fix this? We can make sure you are set up for success by making sure you are eligible for student loan forgiveness, and are on the right repayment plan. We can provide you with all of the correct documentation that you will need to fill out (in the future we can do this part for you as well).

Forgiveness plan flow

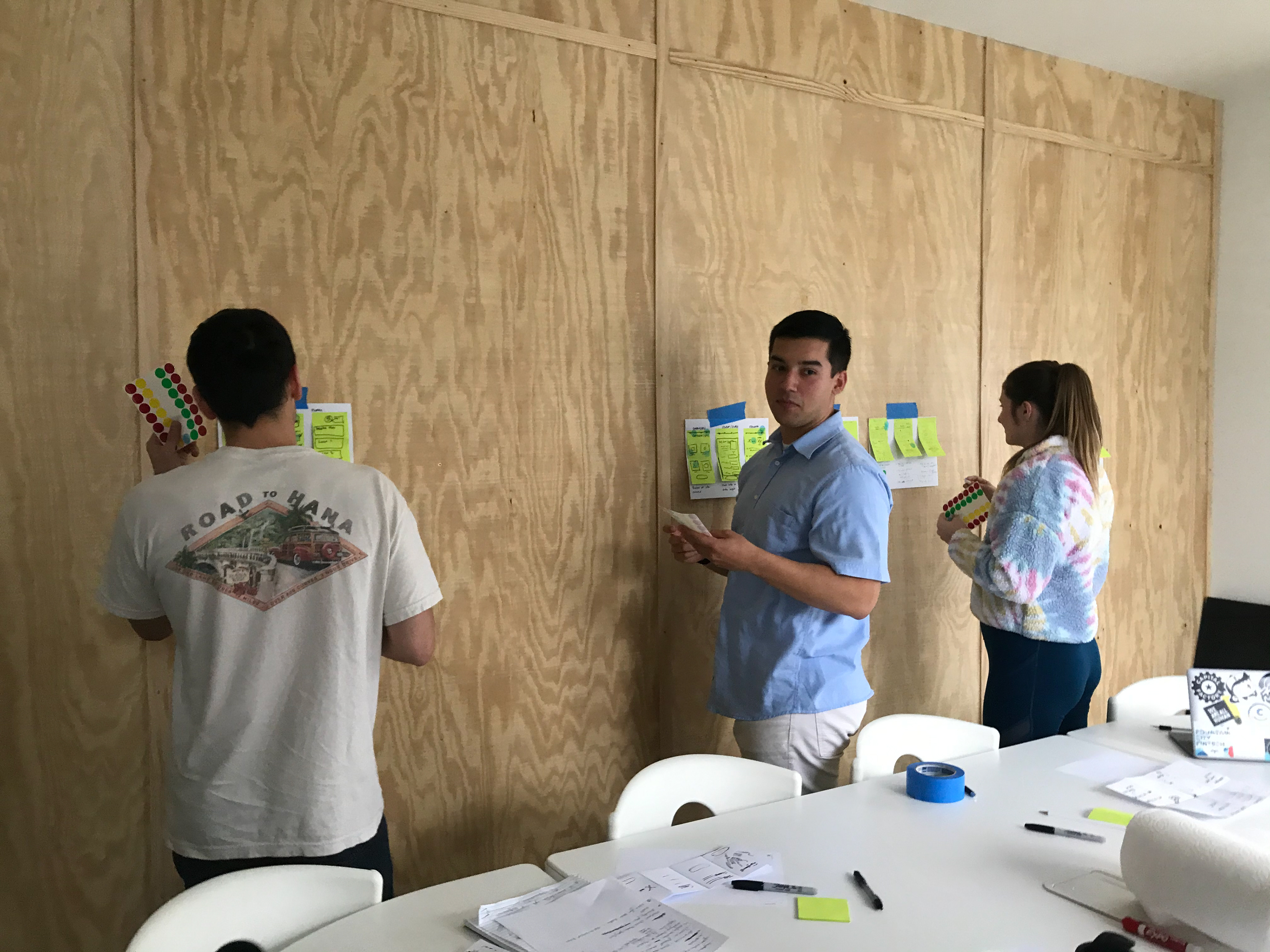

My first design sprint facilitation

This was an amazing experience. I have attended many design sprints but this was my first time facilitating one. This means I had to plan what we would do, how long it would take, and what the outcome should be. In this case we did a one day sprint (Would have done longer, but didn't have permission) that would help us improve the onboarding process for new Chipper app users. The outcome would be a wireframe for me to start working on as a prototype that we then would test with users. We got the whole team involved...all three UT interns, CEO, and developers. We combined our knowledge, and skill to come up with this new and improved wireframe flow.

Beyond creating the flow for forgiveness I also updated the other parts of the app. We have one area we call "Chipaway" that will help you chip away your loans by providing you three options.

1) Boost: Boost helps you schedule monthly payments directly to your loan providers.

2) Round-ups: If you us the Debit card you can buy Starbucks, shoes, food and we will round up to the nearest dollar! For every payment, a little bit of money goes towards your loans!

3) Pool: This is kind of like a go fund me. Just send the link to your family and friends and they can donate to your debt free cause!

One of my favorite things I got to do at Chipper was facilitate my very first design sprint! This design sprint was to find ways to improve the on boarding process. We actually came out with a neat idea to test! Instead of consistently asking very basic questions, to know which part of the app may be the best for them. We decided to make it intuitive and different. By adding a chat bot we could provide yes no questions that would hopefully

1) Help them understand what we do

2) Help them find a better repayment plan

3) Show messaging for the forgiveness flow

4) Provide trust with helpful security features

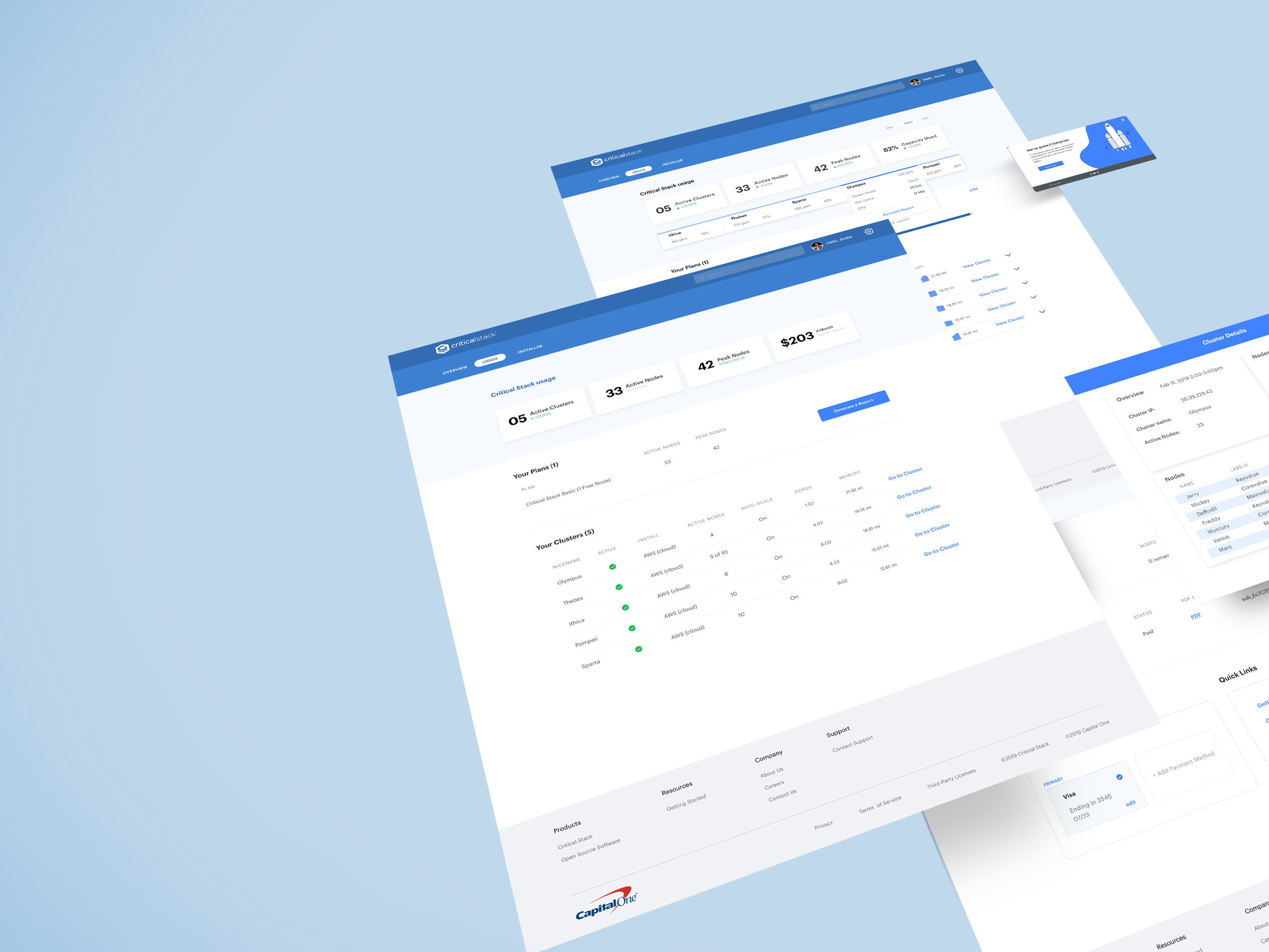

Web Widget

The web widget is a great idea that would allow Chipper to provide access to the forgiveness quizzes and loan calculators within other people's websites and platforms. The end goal of the widget is to get users to sign up, and download the app. With priorities changing, we are making the web widget into a web app. This way we won't have a separate iOS/Android app and would allow for the full experience within the web widget.

Partnership Wireframes

High fidelity mocks

Layers of the Chipper app